Brief introduction

The cryptocurrency market remains extremely volatile and requires quick decisions. Modern trading robots based on artificial intelligence can analyze large amounts of data, generate forecasts and automatically adjust trading parameters – this gives them an advantage over manual trading. Below is an updated review of popular AI bots, their strengths, tariff features and purposes.

TOP 11 AI Bots (Short List)

- Bybit Trading Bot AI

- OKX Bot

- Pionex

- 3Commas

- Cryptohopper

- Trade Santa

- Cryptorobotics

- Altrady

- Gunbot

- Quadency

- Autonius

Detailed notes on each project

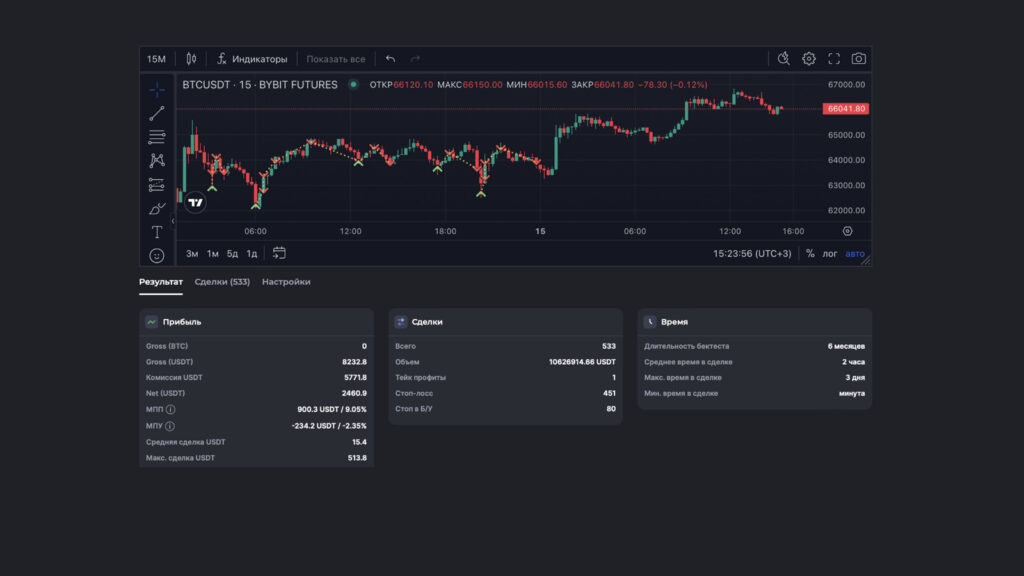

Bybit Trading Bot AI

- Monetization model: free (built-in tool on the exchange).

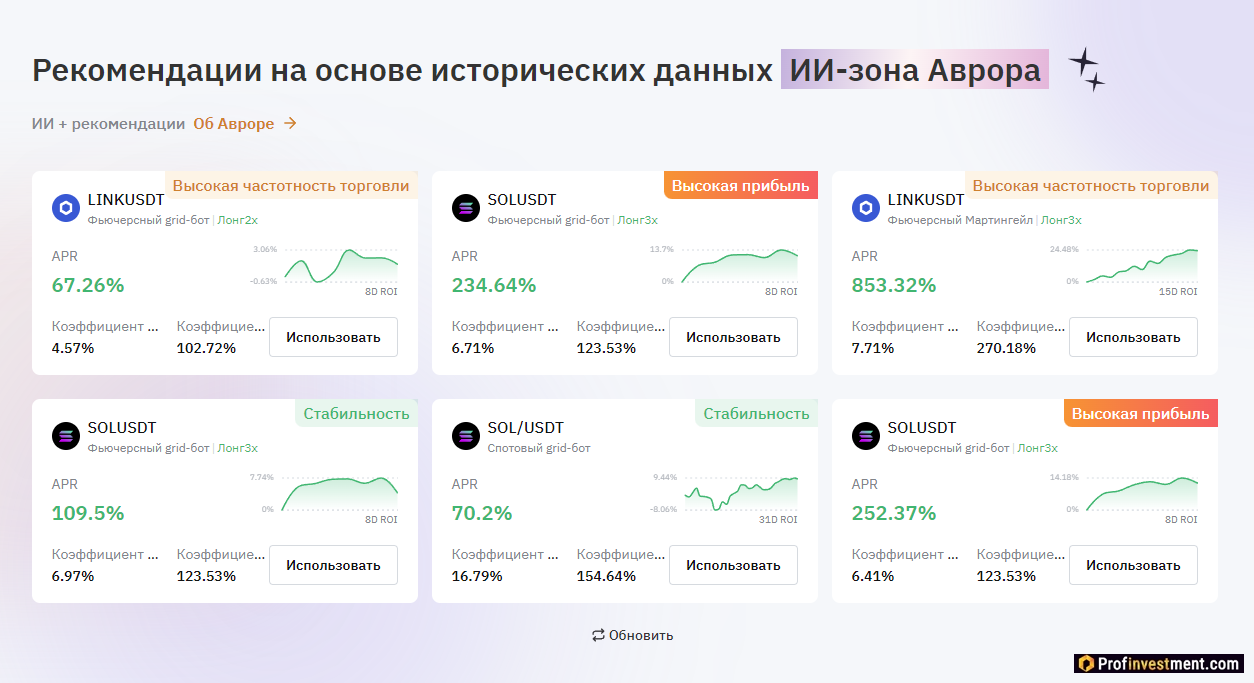

- How AI is used: a specialized neural network (called “Aurora” in the material) analyzes recent market data and selects parameters for ready-made strategies.

- Tools: Support includes grid bots (spot and futures), Martingale options and a set of pre-configured strategies.

- Who it’s for: Those who trade on Bybit and want to quickly deploy an automated strategy without manual setup.

- Tip: Test your bot creations on small volumes first and be sure to use simulation if available.

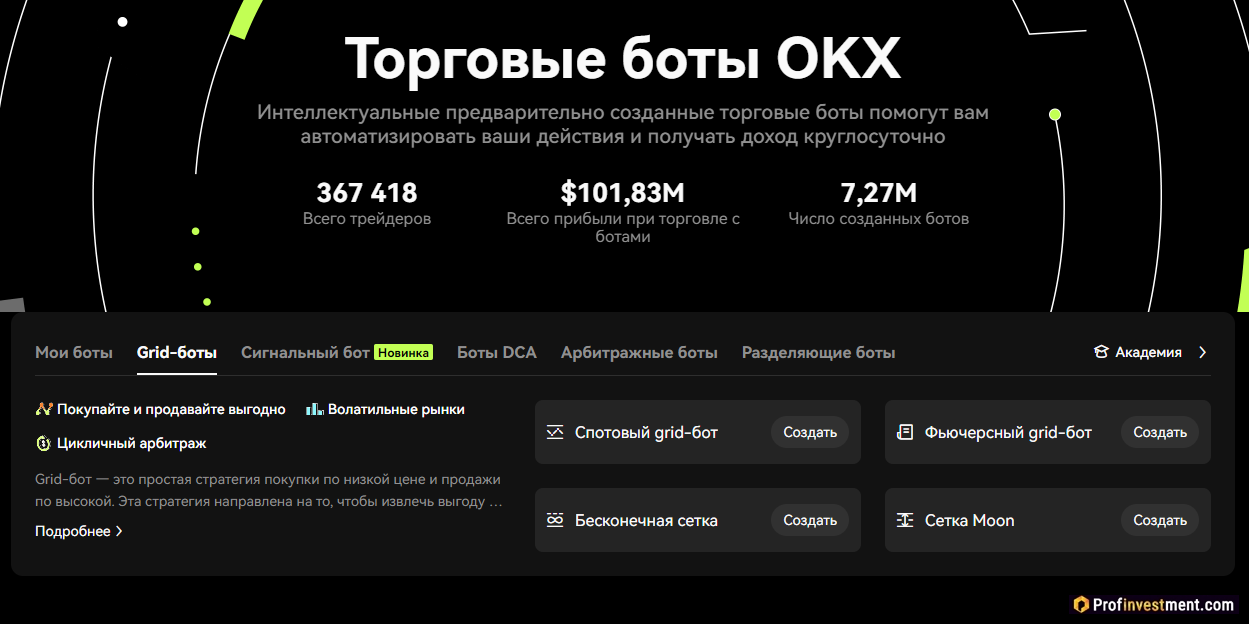

OKX Bot

- Cost: free (exchange tool).

- Features: ready-made intelligent strategies, real-time monitoring, support for grid and DCA approaches.

- Who is it for: OKX users who want to automate their spot and futures trading.

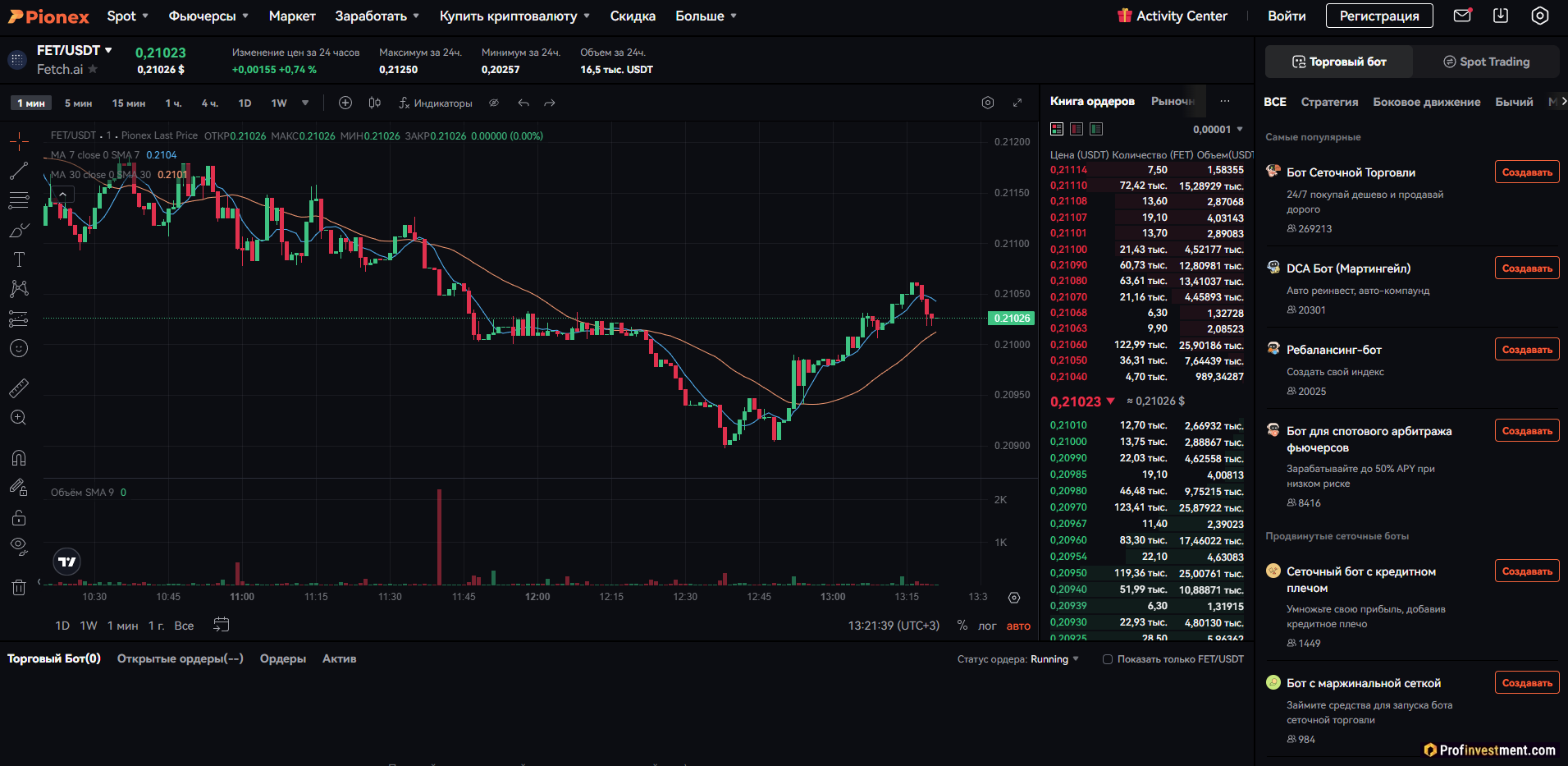

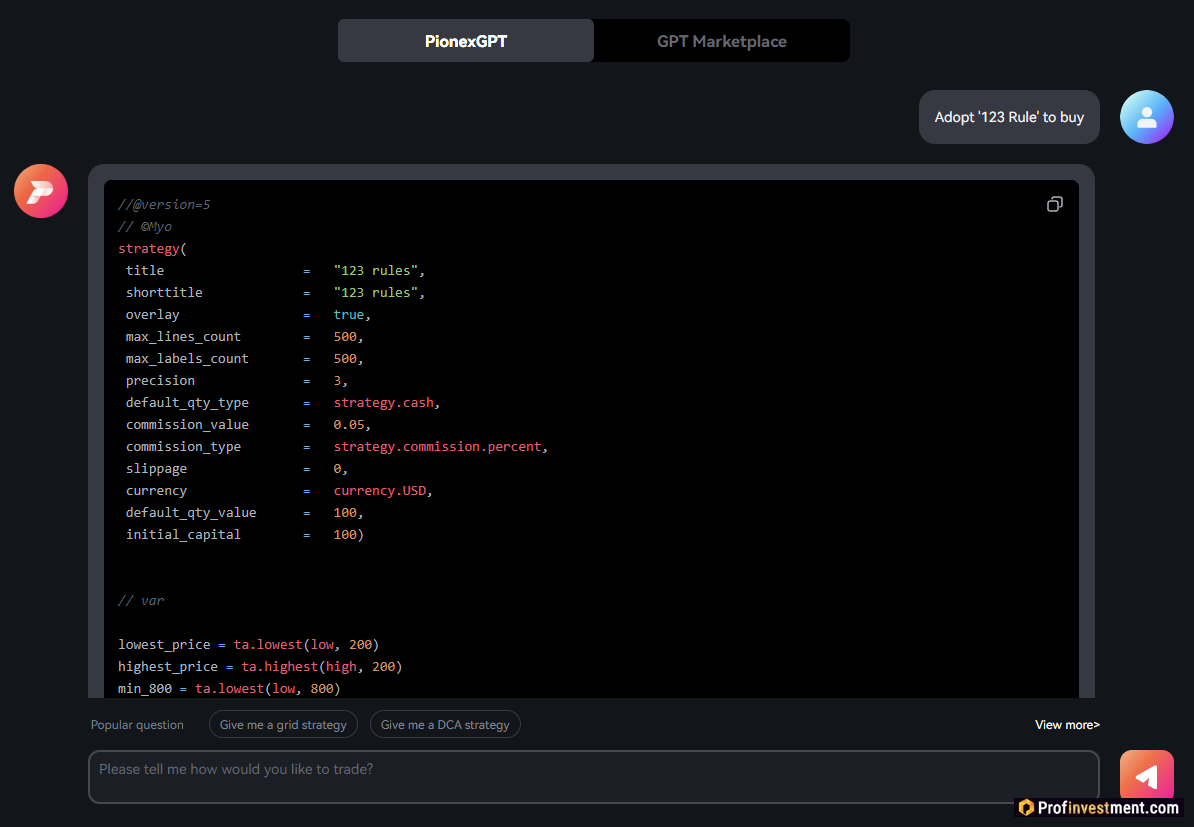

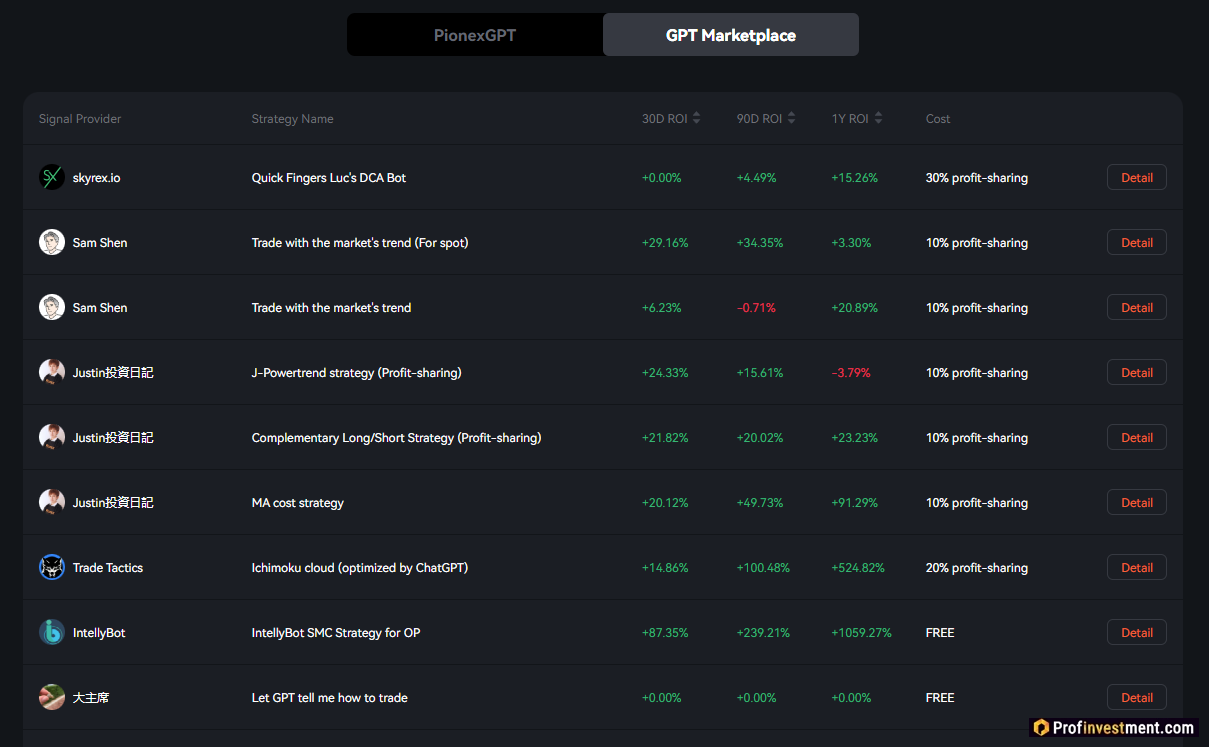

Pionex

- Cost: Basic bots – free (only commission on orders is charged).

- Tools: more than 10 types of bots: Grid, Infinity Grids, DCA, etc.; there is a built-in AI advisor and a Pionex GPT / Marketplace section.

- Who is it for: traders who want ready-made and easy-to-launch solutions with minimal subscription costs.

3Commas

- Cost: mid-range plans available – paid plans available (usually $22 and up).

- Features: grid bots, DCA, Smart bots, integration with multiple exchanges, demo modes.

- Who is it for: advanced traders and those who want flexible settings and multi-exchange strategies.

Cryptohopper

- Cost: There is a free tier and paid plans for advanced features.

- Functions: market making, arbitrage, strategy optimization, signals and strategy templates.

- Who it’s for: Those who want a bridge between signals and automation with the ability to fine-tune settings.

Trade Santa

- Cost: subscription (there are basic paid plans).

- Features: grid and DCA bots, smart orders and simplified strategy setup.

- Who is it for: Beginners who want to run simple automated strategies.

Cryptorobotics

- Cost: From free to paid plans (depending on the set of tools).

- Features: creation and launch of bots, demo mode, analytics, smart orders.

Altrady

- Cost: There is free access and paid plans.

- Features: grid bots with trailing, signal tools, monitoring of multiple exchanges.

Gunbot

- Monetization: licenses (lifetime options in BTC, there are different packages).

- Features: Local application (installed on PC), supports prototyping of AI/automation based strategies.

- Who it’s for: Those who value autonomy and local storage of keys, as well as strategy developers.

Quadency

- Cost: Free features available; paid options depend on the tools required.

- Features: Cody AI trading assistant, multi-exchange bots, smart orders and portfolio monitoring.

Autonius

- Model: paid access + separate purchase of tokens/payment mechanics (NIOX).

- Features: decentralized trading terminal, strategy marketplace, user controls hosting.

AI Advisors and Chat Assistants for Trading

In addition to classic bots, several projects offer chat interfaces and “advisors” based on GPT/neural networks. These tools help to create trading ideas, generate strategy code, and even connect automatically tested templates.

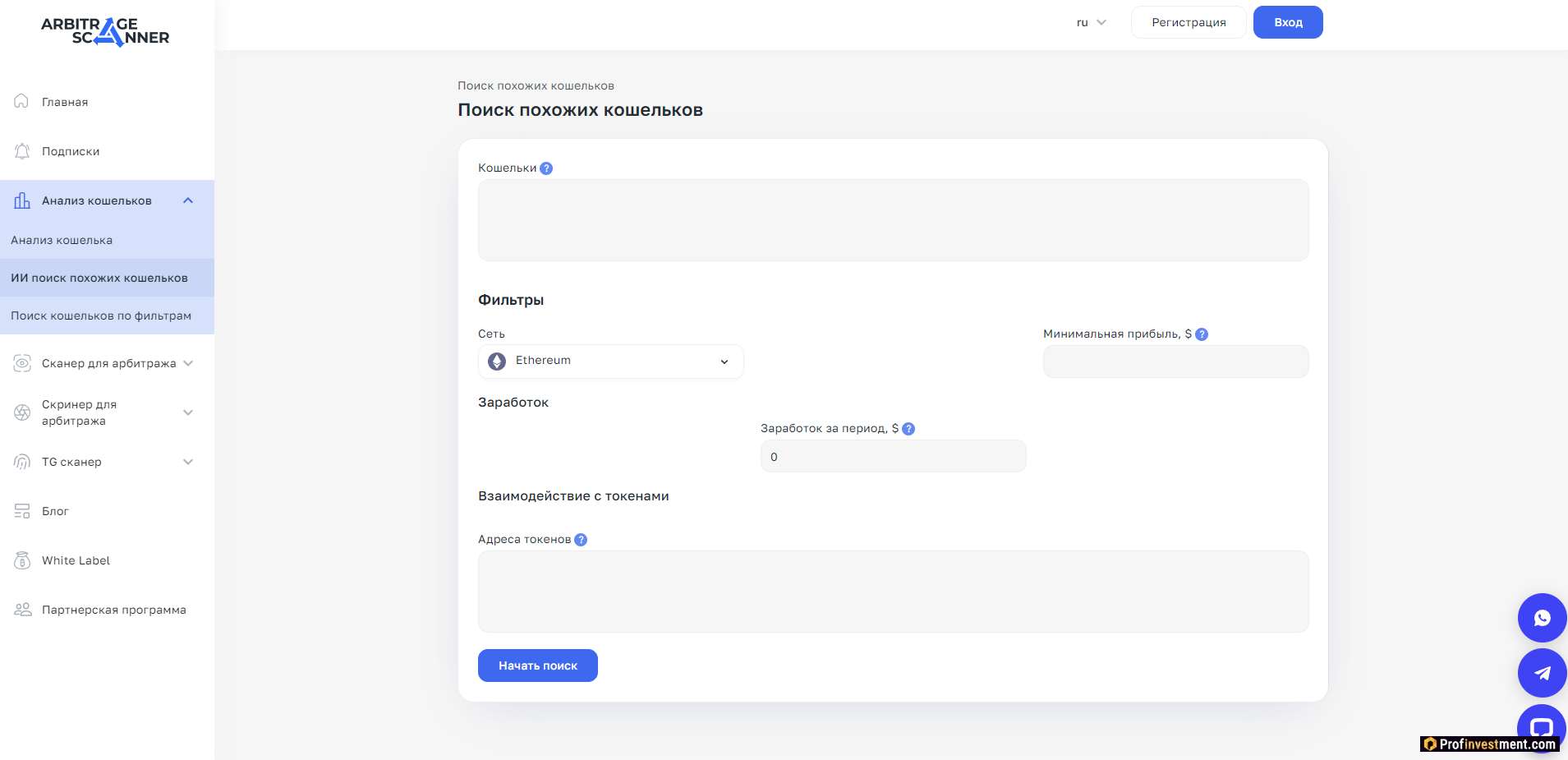

Examples: Pionex GPT / Marketplace, Bybit Chat, ArbitrageScanner — tools for analyzing and automating ideas. Below are a couple of illustrations of interfaces and marketplace environments.

Comparative summary (excerpts)

| Project | Monetization type | Key function |

|---|---|---|

| Bybit Trading Bot AI | Free (on the exchange) | Automatic adjustment of strategies via AI (Aurora) |

| OKX Bot | Free (on the exchange) | Ready-made intelligent bots and monitoring |

| Pionex | Basic free | Lots of built-in bots + GPT/Marketplace |

| 3Commas | Paid plans | Flexible multi-exchange instruments |

| Gunbot | Licenses (for life) | Local strategies, high customization |

| Autonius | Subscription + token | Decentralized terminal and marketplace |

Benefits and risks of AI bots

Pros

- Automation of trading 24/7, elimination of emotional decisions.

- Big data analysis and rapid testing of ideas.

- Possibility of scaling and working on several exchanges simultaneously.

Cons and Warnings

- There is no guarantee of profit – AI relies on historical and current data, which can be misinterpreted.

- Technical errors, API vulnerabilities and security risks (keys, accesses).

- The quality of the result depends on the reliability of the input data and the volume of testing.

FAQ – Brief Answers

Do you have to pay to use AI bots?

Many exchange solutions are free (integrated into the platform), third-party services often have subscriptions or licenses. Always check the payment model before launching.

Can you trust fully automated strategies?

No – it is recommended to start with a demonstration/simulation, limit the capital and monitor the robot’s behavior in different market conditions.

Conclusion

AI bots greatly expand the possibilities for automated trading, but do not eliminate risks. The approach of “diligent due diligence + gradual capital injection” remains key. The choice of a specific tool depends on the level of experience, the required flexibility and attitude towards managing private keys/API access.